By Julian Jansen, Growth and Market Development Director (EMEA) and Lars Stephan, Senior Policy and Market Development Manager (EMEA)

Fluence Proposes Volatility Contract for Difference (CfD) as Part of the European Electricity Market Design Reform

In 2022, Europe’s energy markets were shaken by a multifaceted crisis driven by a shortage of natural gas and resulting price increases. The European Commission responded with a pledge to accelerate Europe’s energy transition and several emergency interventions to reign in prices for consumers. In February 2023, it followed with a consultation on Reform of the EU’s Electricity Market Design, which is expected to lead to a legislative proposal in March.

The Need for Greater Recognition of Energy Storage

At the center of the electricity market design discussion is the question of how to best integrate low-cost renewable energy into the European power system – the question that will become even more pressing over the coming years. The initial main reaction of the European Commission to the energy crisis was to double down on the deployment of renewable energy generation assets. The REPowerEU package calls to bring 600 GW of solar online by 2030, 320 GW of which by 2025.

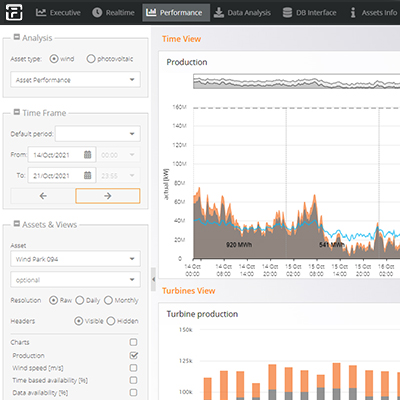

Based on the accelerated build-out of renewables, market analysts forecast energy storage deployment to double in Europe to more than 80 GW between 2022-2030. The primary driver behind this is the need for energy storage to provide the flexibility necessary to integrate the increasing levels of renewable generation.

Figure 1: Annual Battery Energy Storage Installations (MW) Forecast in Europe adjusted for REPowerEU

Source: Data adapted from range of sources including IHS Markit/S&P Global, BNEF, WoodMac.,

and Data includes some markets outside of the EU such as the UK

But in contrast to the US, Australia, or some EU countries, the EU lacks a concrete policy framework for the deployment of energy storage, such as an EU-wide target or strategy for energy storage. Additionally, the current European electricity market design has no dedicated support mechanism that would support the rapid and large-scale deployment of new storage projects. For the EU climate plans to be successful, the investment into renewable generation must be accompanied by adequate investments into energy storage and other flexibility technologies.

The Need to Incentivize Investment into Energy Storage

Despite the growth of energy storage installations across Europe, we are far from seeing the scale of investment into energy storage required to accompany the build-out of renewables. One key reason is that energy storage is at a disadvantage in attracting investments compared to other assets in the energy systems. Power grids receive a regulated return, and hence guaranteed income, over their assets’ lifetime. Renewable generators receive investment guarantees in the forms of Contracts for Difference (CfDs) or feed-in tariffs that provide long-term revenue guarantees of up to 20 years in most EU member states. Investments in traditional power plants are often supported by long-term contracts for capacity, so called capacity markets. In most member states with capacity markets, energy storage can regularly participate in capacity auctions.

In comparison, energy storage generates the overwhelming majority of its revenue via participation in ancillary services (such as frequency regulation), and in balancing and wholesale markets (such as Day-Ahead (DA) and Intraday Spot Markets). These markets transact one day in advance of physical delivery and do not allow locking in long-term revenue streams. However, these are required as collateral to attract low-interest debt funding, such as loans or investments from infrastructure funds. Having the ability to secure long-term contracts is vital for the large-scale deployment of energy storage assets in Europe.

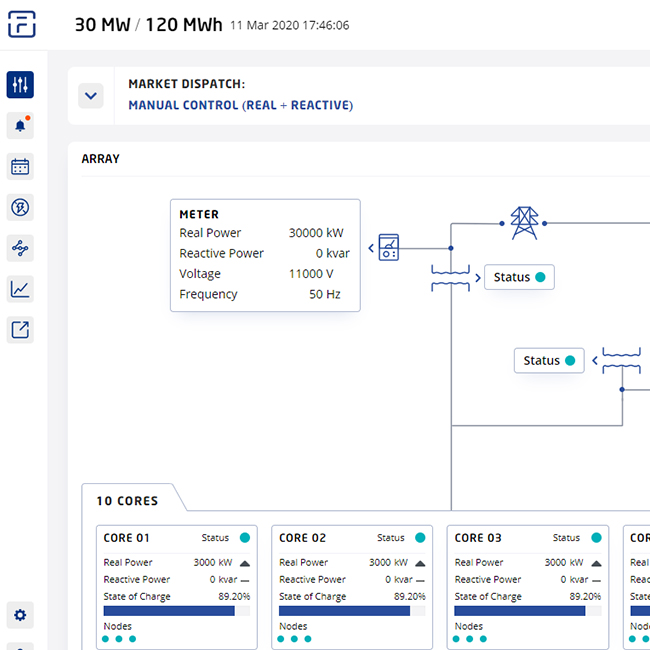

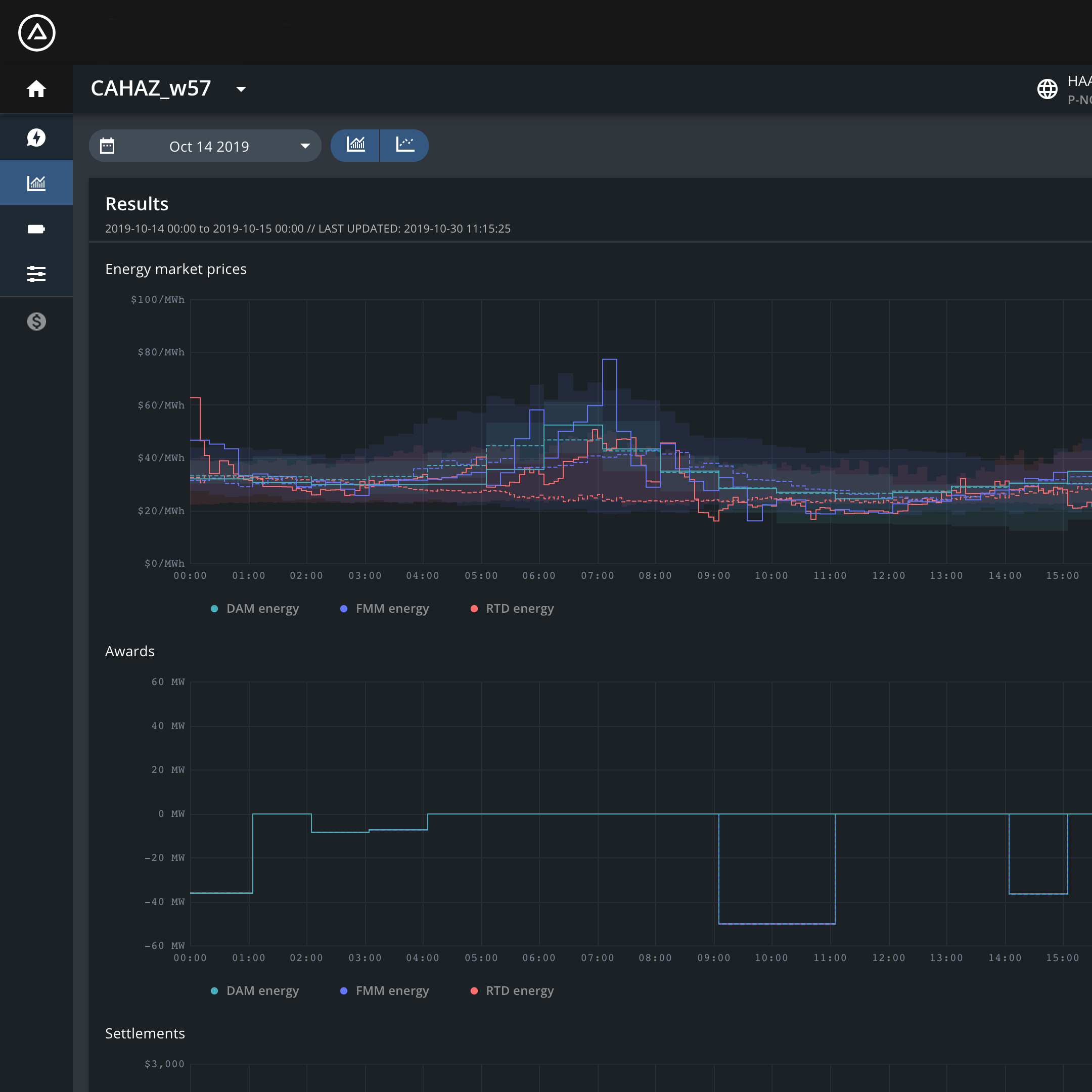

Figure 2: Overview of Volatility Cfd as swap between guaranteed Day-Ahead Revenues and benchmark revenue based on actual wholesale market volatility

Volatility CfD: De-Risking Investments into Energy Storage

The European Commission declared its intention to provide a stable investment environment for the energy sector, including long-term contracts to incentivize the build-out of the required energy infrastructure of the future.

This is why Europe needs a sensible market design reform that de-risks investments into energy storage and other flexible technologies and levels the investment playing field between storage and other types of assets. To achieve this, Fluence proposes a CfD on wholesale market volatility, called Volatility CfD.

Our proposal for a Volatility CfD can be summarized in the following points:

1. Creating Investment Certainty

- The Volatility CfD increases investment into flexible technologies by providing flexible assets with a long-term contracted revenue based on a two-sided CfD on wholesale market volatility

- The parties to the Volatility CfD are flexibility asset owners or operators (CfD holder) and a central buyer (government entity)

- The CfD holder receives a long-term revenue guarantee for a pre-defined volatility at the DA Market; the guaranteed volatility or spread is called the strike price

- The double-sided Volatility CfD has a 10-year term

2. Defining Volatility

- The underlying index of the Volatility CfD is the price volatility or price spread in DA Spot Markets for electricity, measured as the difference between the cheapest and highest hourly electricity price per day

3. Awarding Volatility CfDs

- Volatility CfDs are awarded in annual, technology-agnostic auctions, based on a CfD strike price, ensuring the lowest cost assets are awarded

- The volume of CfD auctions is assessed by the national regulator based on a flexibility need assessment of the respective electricity system

4. Settlement of the Volatility CfD

- The Volatility CfD is settled on a monthly basis: In exchange for the guaranteed strike price, flexibility assets return a benchmark revenue based on actual wholesale market volatility. Payments between the CfD parties can go either way.

- If the actual wholesale market volatility is lower than the guaranteed CfD strike price, the CfD owner will receive the payment to make up the difference; if the actual wholesale market volatility is higher than the CfD strike price, the CfD owner will have to pay back the difference.

5. Operational Requirements

- Volatility CfDs are providing a firm revenue floor against DA volatility; projects still need to optimize against all available markets (energy, ancillary, capacity) to reach project profitability

- Flex assets have no obligation to operate in DA markets. The CfD incentivizes them to operate in those market segments with highest potential revenue, as indication of a highest overall system benefit

Volatility in Wholesale Markets as the Measure for Flexibility Assets

The Volatility CfD is not based on the price of electricity in wholesale markets, as traditional CfDs, which guarantee renewable generators a price for the electricity they produce. Flexibility assets operate based on spreads in wholesale markets, hence the difference between high and low prices. The Volatility CfD is therefore not to be based on an absolute cost of electricity, but on the daily volatility between highest and lowest prices for electricity in DA spot markets, as shown in Figure 3.

Figure 3: Example for the Definition of the CfD strike price

based on Day-Ahead volatility

Like traditional CfDs, the Volatility CfD is two sided. In settling the payout between flex asset operator and the central counterpart, the CfD strike price, that is awarded in the CfD auction, is compared with a benchmark revenue based on actual wholesale market volatility. If the actual volatility is lower than the CfD strike price, the operators of the flexible assets receive a payment from the central buyer entity to make up the difference. But if the actual volatility in wholesale markets is larger than the CfD strike price, operators of flexibility assets would have to return the difference, and therefore some of their profits, to the central buyer.

In sum, the payments between both parties should balance each other out and therefore be revenue neutral. Still, the structure would allow to partially transfer the long-term revenue risk for the operation of the assets to the government entity and thereby allow risk-adverse, and hence cheaper, capital to be used to accelerate the build-out of flexible technologies like energy storage. The tool would therefore achieve the same outcome as traditional CfDs for renewable generators.

CfD Auctions

The Volatility CfD structure uses other principles well established in European energy markets. CfD-contracts would be awarded by auction, which means that the cheapest technology for providing flexibility is to be awarded. Assets could also operate in energy markets without having a CfD-contract. In the auction, a pre-defined volume of CfD contracts would be made available and the assets with the lowest required strike price are awarded with Volatility CfD contracts. The volume of the CfD auctions could be set by national regulators based on a cost-benefit analysis on how much additional flexibility would result in an optimized efficiency of the energy system.

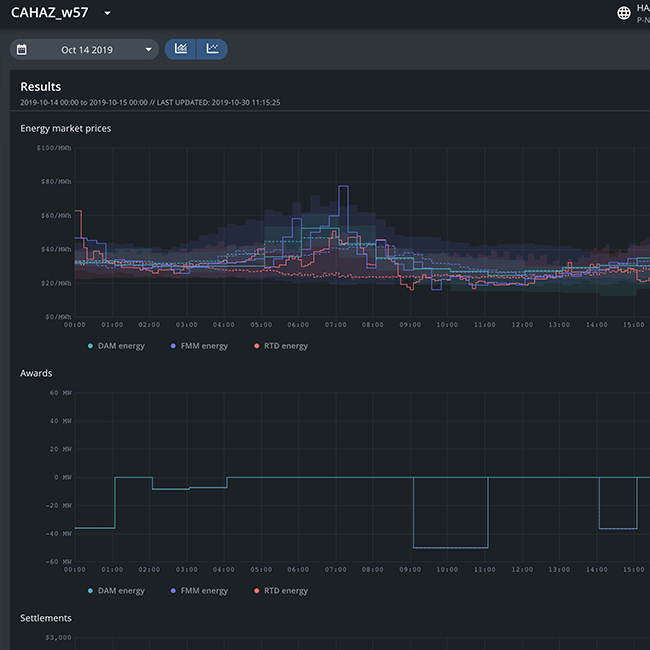

CfD Revenue Is Only Part of Asset Revenue Streams

A difference compared to traditional CfD is that the CfD payments only represent part of an asset’s revenues. Energy storage typically stacks different revenues, which means that it operates in different markets or switches between them depending on where it can earn the highest revenues. Such markets include short-term spot markets, like DA or Intraday markets, ancillary service, balancing, or capacity markets. The revenue from the DA market is only part of the asset’s revenues and the revenue from the Volatility CfD is not enough for a storage asset to reach a positive business case. Flexibility assets under the CfD structure are therefore incentivized to optimize their operation based on all accessible revenues. This is in line with the principal idea behind the CfD, which should not provide flexibility assets with their whole revenues but keep operators of flexibility assets alert and innovative in the way that they operate and optimize their assets.

Figure 4: Full Revenue Stack of flexibility asset under CfD

This also means, in turn, that assets under the CfD can’t “game” the system, by just providing what the CfD required from them, as this would leave them with missing income to be profitable.

Volatility CfD as Financial Construct

The final element of the CfD is its financial structure. The bi-directional payment flows are based on DA wholesale market volatility, but the awarded assets are not obliged to actually participate in the DA market. It only serves as the benchmark for payments of the volatility CfD. While this seems counterintuitive at first, it comes down to the versatility of flexibility assets that can operate in different market segments. As outlined above, flexibility assets under the CfD are incentivized to operate in the market that earns them the highest revenue. As prices act as a function of scarcity in the system, flexibility assets that optimize against various markets within the energy system automatically optimize the overall energy system. If flexibility assets were required to participate in a specific market, they might not be able to support the energy system in different segments, where their deployment would be most beneficial.

Energy Storage Creates Value for the Energy Transition

Finally, the public rational for supporting such CfD is the socio-economic benefit that flexibility assets create, including lowering peak prices and replacing gas assets from the market. The same way that we incentivize the build-out of renewable generation assets and power grids, we should simultaneously incentivize the build-out of flexible technologies that allow for the faster and efficient integration of renewable energy.